In today’s modern era, when everything has gone digital, banking is now at your fingertips, and FAB (First Abu Dhabi Bank) makes it easy and really possible, Fab Bank customers now have the facility to check FAB balance online, send money internationally, Now customers can easily send money abroad, grow their business, or manage their finances online. Fab Bank is now providing unique and streamlined solutions to its customers for every need.

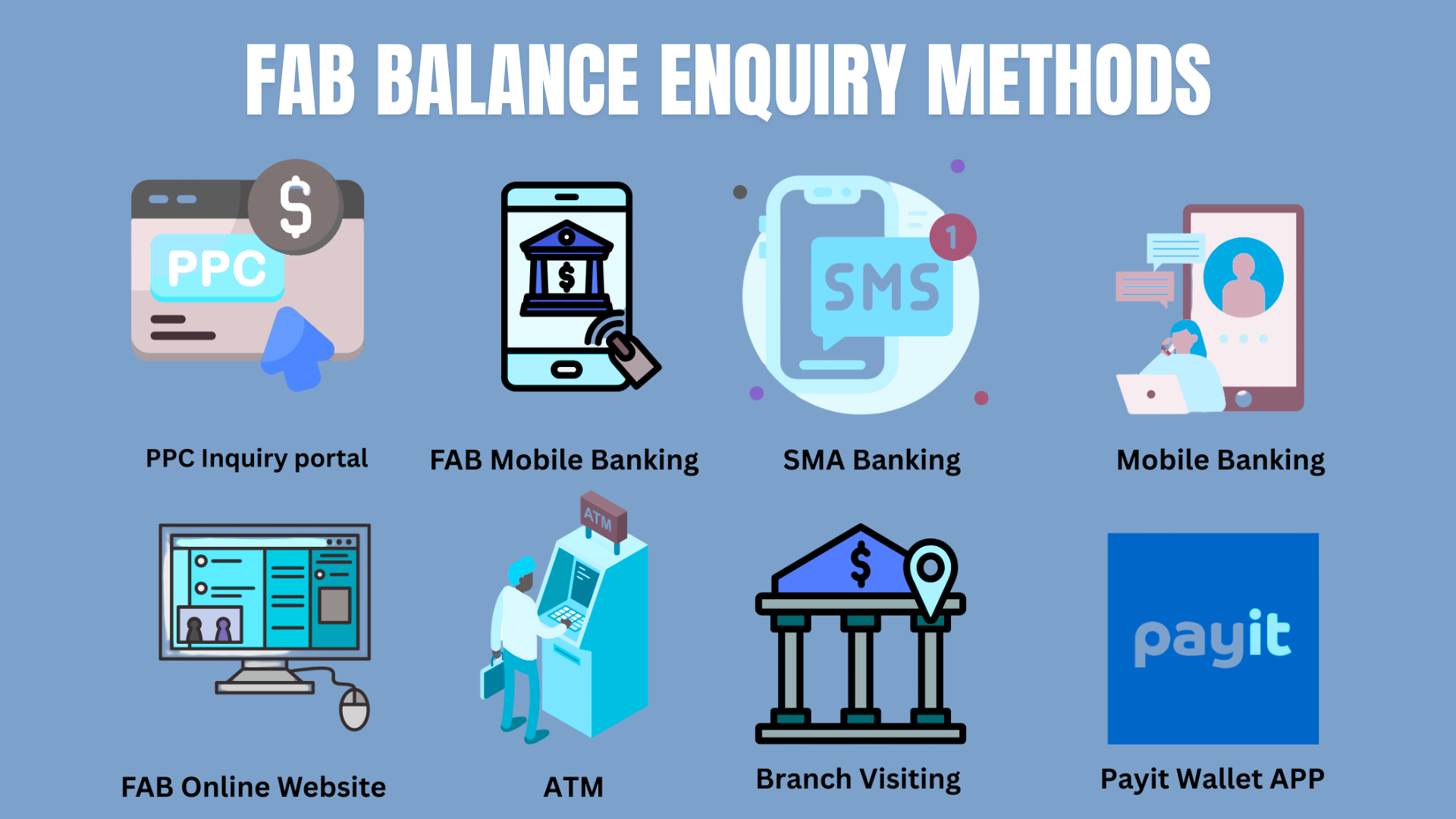

10 Super Fast Ways to Check Fab Balance Online

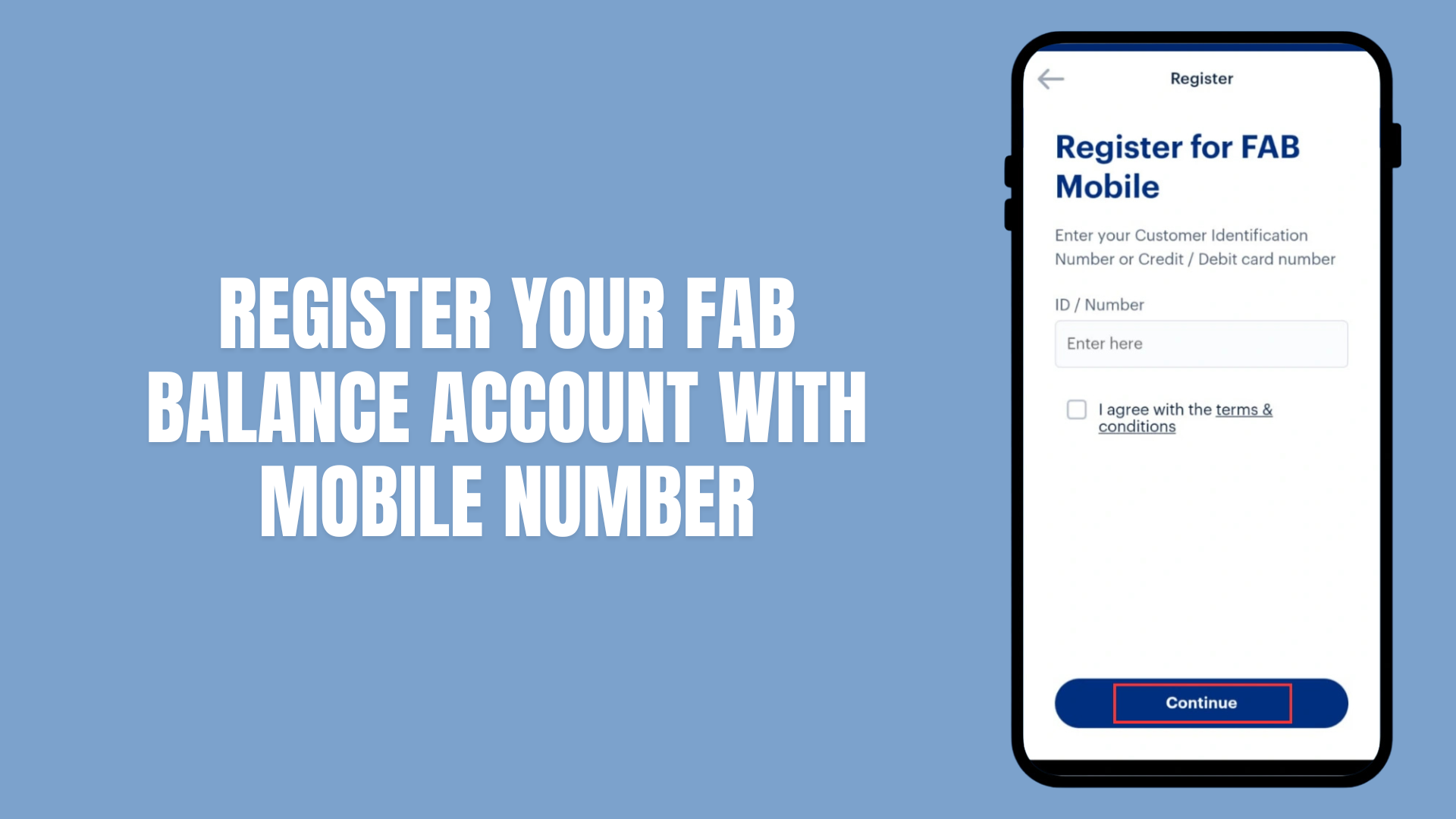

You cannot check your Fab balance or perform any banking transactions without registering your mobile number for Fab Online Banking Services

Registering for online banking is not rocket science, during registration, some important information is asked on the screen, After providing all this information, you will be easily registered for mobile banking. However, we will provide you with a table after the registration section, So that you can clearly understand if there is any question left in your mind regarding Fab Bank Ratibi card salary check online.

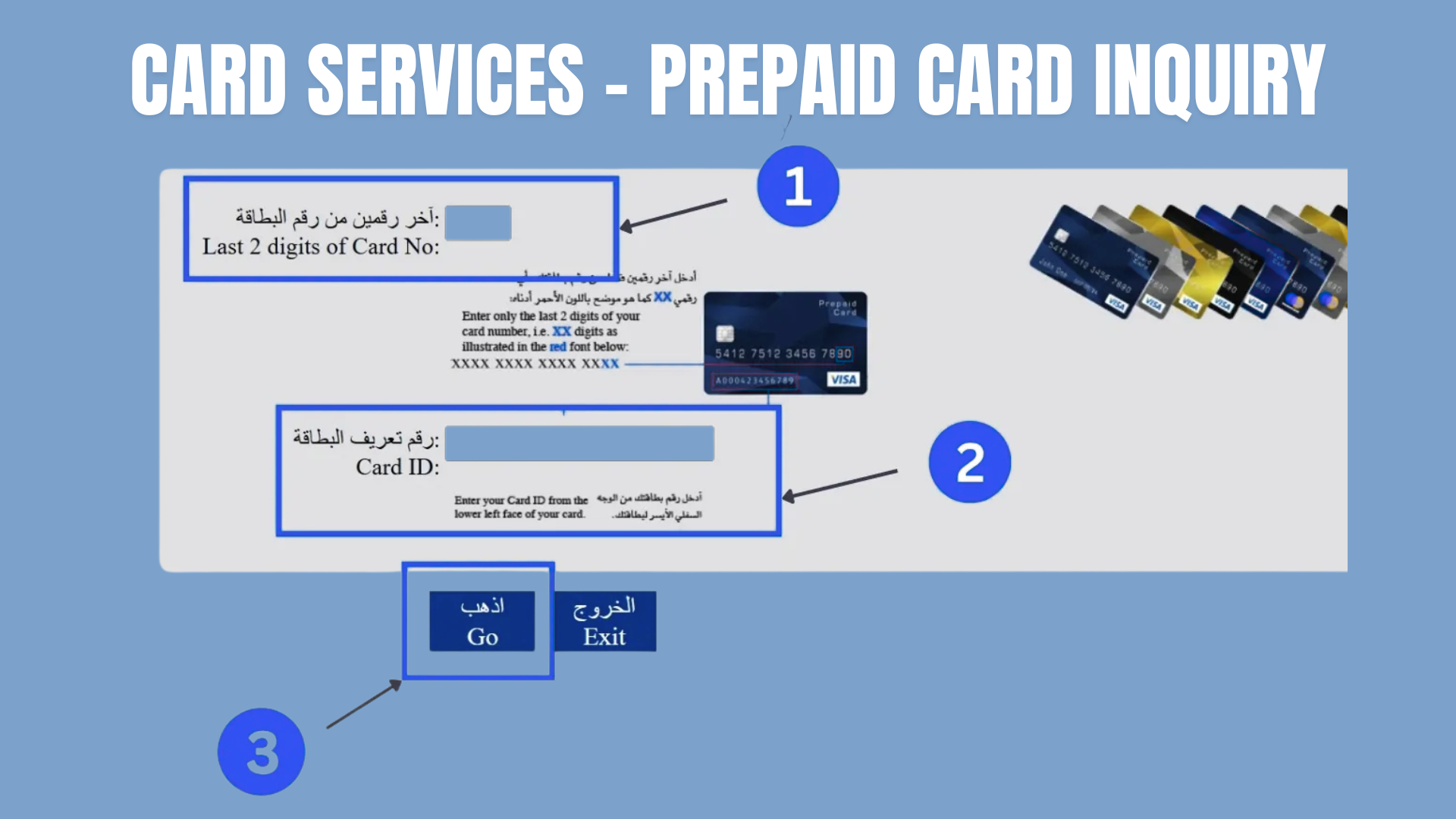

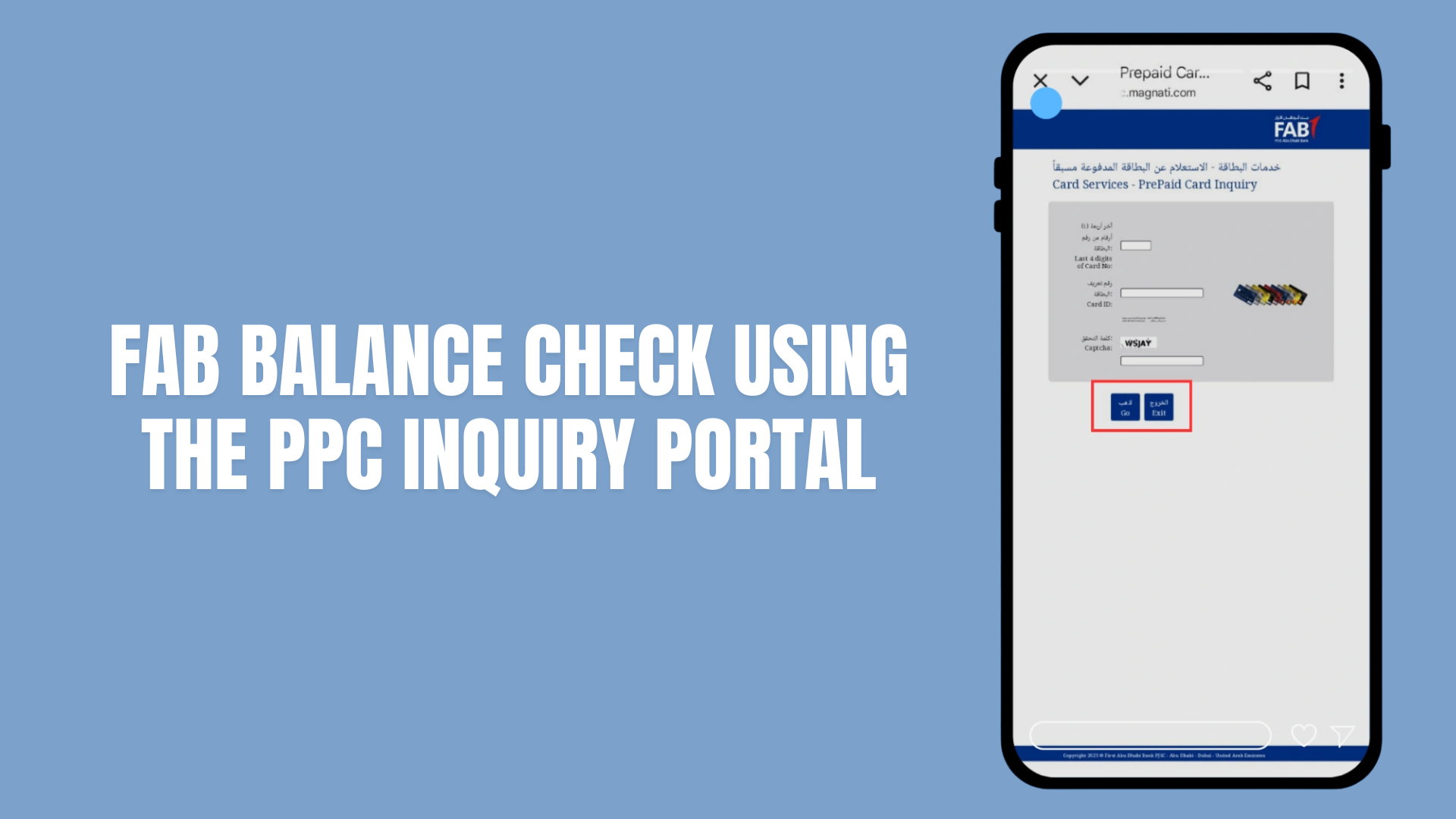

FAB Balance Check Using The PPC Inquiry Portal

This method is specific to PPK Fab balance inquiry and Prepaid Cards enquiry free.

Tips and Troubleshooting

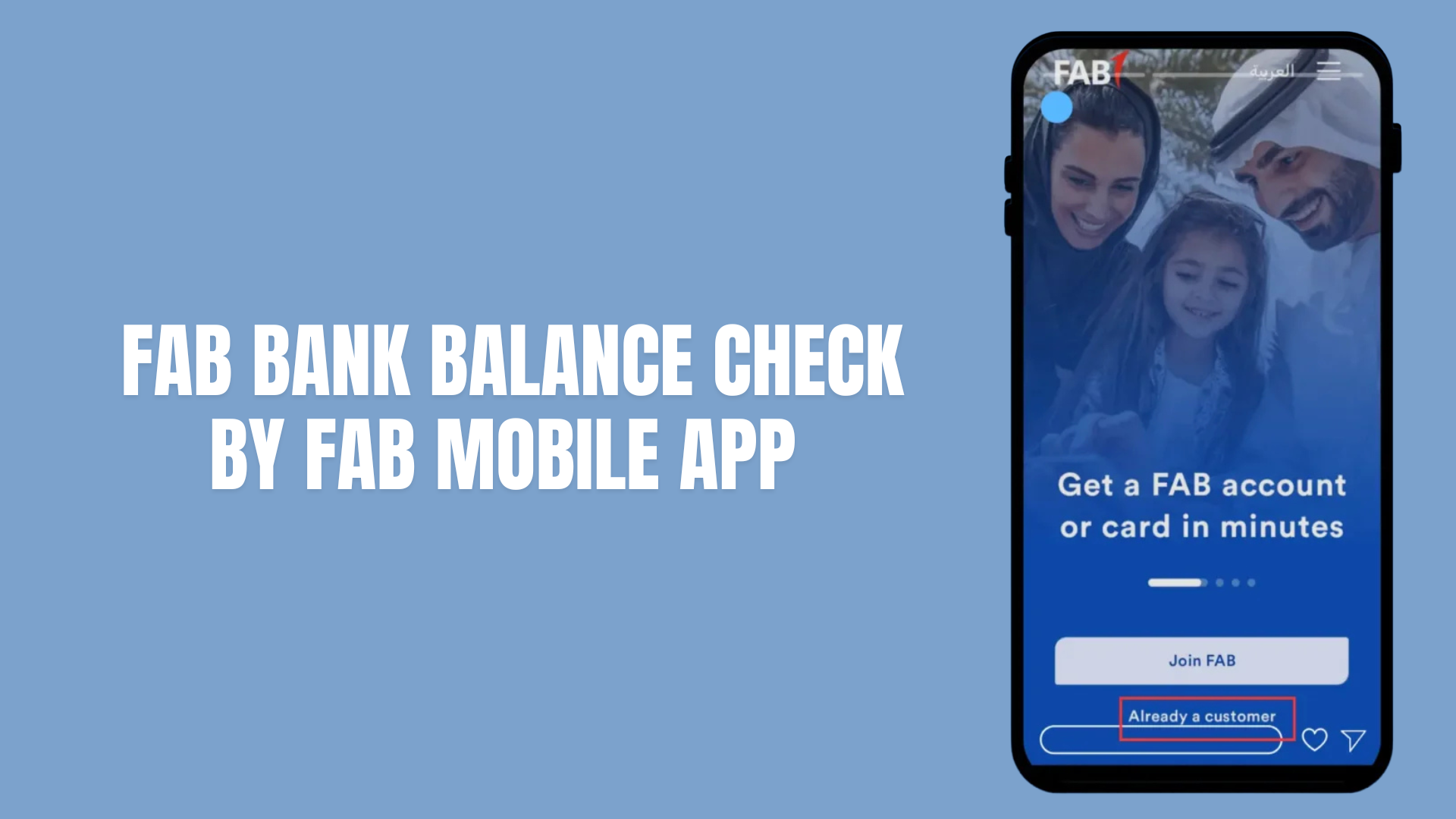

FAB Bank Balance Checking by FAB Mobile App

If you want to check your Fab Bank balance from Fab Mobile App then, If you want to check your Fab Bank balance from Fab Mobile App, then complete information is being provided for you here. The mobile app will ask for your registered mobile number. To avoid problems, please provide the same mobile number that is registered with your Fab Bank account or for receiving the card.

Type it in the correct Format

Provide your fab and card details

Create your login Details

Open the app and tap Already a Customer

Small but useful things the app does

Safety Tips For FAB Balance Check

FAB Mobile Banking APP Troubleshooting & easy fixes

Fab Balance Check Salary via SMS

You can check FAB bank balance inquiry or salary check via SMS without requiring internet connection.

Make Sure SMS Banking Is Registered

Option 1: Register Through an FAB ATM

Option 2: Register via Customer Care

Option 3: Register at an FAB Branch

Your SMS PIN is different from your ATM PIN so, keep it secure and private.

Send an SMS to Check FAB Balance

Step 3: Receive and Read Your Reply

Within 30–60 seconds, you’ll get an SMS from FAB-BANK showing:

Tips & Best Practices (2025)

FAB Balance Check Via Phone Banking ( Best for Non-tech Users)

If you don’t have internet access or aren’t comfortable with technology, phone banking is the best option for you. No internet, no apps—just a quick call, and you’ll instantly get your FAB account balance or prepaid card balance.

Why Phone Banking is Best for Non-Tech Users

Steps :

Contact FAB customer support

Choose Your Language

The automated voice will ask for your language

Now, click on the Balance Inquiry option

Provide your Details :

Primary Information (One of the following)

Verification Details

Security Information

Here is the table by which you can easily decide which one to use and why.

| Feature | Automated Voice System (IVR) | Customer Service Representative |

|---|

| Phone Numbers | 600 52 5500 (UAE) +971 2 681 1511 (Intl) |

600 52 5500 (UAE) +971 2 681 1511 (Intl) |

| Access | Menu prompts: 1-English, 2-Account Services, 1-Balance, 0-Agent | Press 0 or wait to speak to agent |

| Speed | 2–3 min | 3–7 min (may be longer at peak) |

| Language Support | Arabic, English | Arabic, English, others |

| Best For | Tech-savvy, quick checks, regular users | Non-tech, first-time users, complex queries |

| Availability | 24/7 | 24/7 (longer waits at peak) |

| Info Required | Account number, DOB or PIN | Account number, name, Emirates ID, DOB, mobile |

| What You Get | Balance, total, last txn | Balance, total, last txn, account status, explanations |

| Pros | No wait, consistent, private | Human help, personalized, resolves issues |

| Cons | Confusing for beginners, limited functions | Wait times, must speak clearly, less private |

| Error Handling | Limited, may need to redial | Excellent, agent corrects mistakes |

| Extra Services | Balance, basic txn history | Balance, explanations, problem resolution, card blocking, service requests |

| Privacy | High | Medium |

| Reliability | Very reliable | Very reliable, human backup |

| Learning Curve | Moderate | Easy |

| Cost | Free/local charges | Free/local charges |

| Wait Time | None | 1–5 min (instant off-peak) |

| Peak Impact | None | Longer waits 9–11 AM, 1–3 PM, Sun–Thu |

Additional Phone Banking Services You Can Use

You can use the phone banking services for :

How to Check FAB Balance via Online Banking (Official Website)

The FAB Online Banking Portal is a secure, feature-rich way to check balances, view transactions, and manage your accounts from any web browser—no app required. It’s ideal for desktop or laptop users who want complete control over their banking.

Open the Official FAB Website

Now a screen opens in which you need to login and after logging in , you can instantly check your FAB Balance.

Log In to Your Online Banking

Multi-Factor Authentication (MFA)

This extra step keeps your account safe from unauthorized access.

View Your Dashboard

Once logged in, the Dashboard gives you an instant VEIW of your accounts:

Access Detailed Account Information

Other details:

Advanced Online Banking Features

Online banking is more than just checking balances. You can also:

Security Measures You Should Know

FAB takes your online safety seriously:

Always log out after each session, especially on shared devices.

Troubleshooting Common Issues

How to Check FAB Balance at ATMs

Find a Nearby FAB ATM

Popular 24/7 Locations in Dubai

ATM Locations Across the UAE

| City | ATM Location | Operating Hours | Processing Time |

| Abu Dhabi | Khalifa Business Park, Al Qurm | 24/7 | Instant |

| Dubai | Dubai Mall, Lower Ground Level | 24/7 | Instant |

| Dubai | Dubai Marina, Marina Walk | 24/7 | Instant |

| Al Ain | Al Ain Mall, Near Main Entrance | 24/7 | Instant |

| Sharjah | Sharjah City Centre, Ground Floor | 24/7 | Instant |

| Ajman | Ajman City Centre, Ground Floor | 24/7 | Instant |

| Ras Al Khaimah | Al Naeem Mall, Al Qusaidat Area | 24/7 | Instant |

Go to the ATM for FAB ATM balance Check

Enter Your PIN

Choose Your Language

Most ATMs let you pick between:

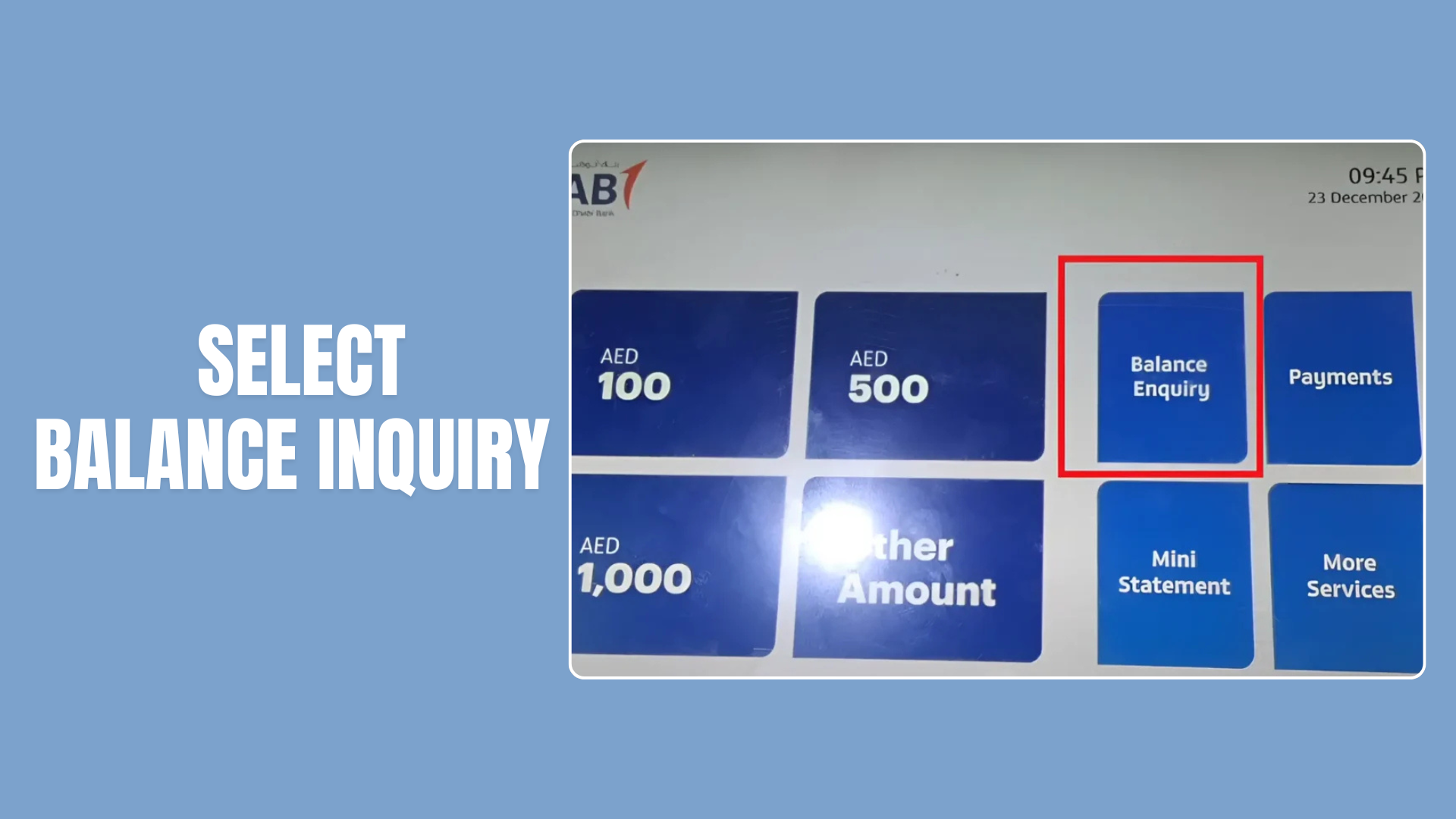

Select “Balance Inquiry”

Select Your Account

If you have multiple accounts linked to the same card:

Select the one you want to check.

View Your Balance

Once selected, your account balance details will appear on the screen, showing: